American Economics: The Business Cycle

Every four years men from far and wide cast their hats into the national ring of electoral politics and compete for the job of President of the United States of America. Each time this process occurs the the nation appears to go through serious soul searching. We debate, we poll, we campaign and we fund raise. In November the American people, after listening to this great public discourse (please note my sarcasm here!), elect a President. Well, some will say the most important issue may be foreign policy or character or the amount of money in a candidate war chest but there is really only one thing that most Americans really care about… the economy.

If history tells us anything it is that when time are good political parties and candidates stand a very good chance of being reelected and when times are bad the incumbent had better start packing his bags for whatever state he came from. Hearken back to the immortal words spoken by then candidate William Jefferson Clinton in a debate versus incumbent George Herbert Walker Bush when asked what the most important issue in the election was: “It’s the economy stupid.” Clinton had his finger on the pulse of the nation (no pun intended), Bush did not and thus Bush lost.

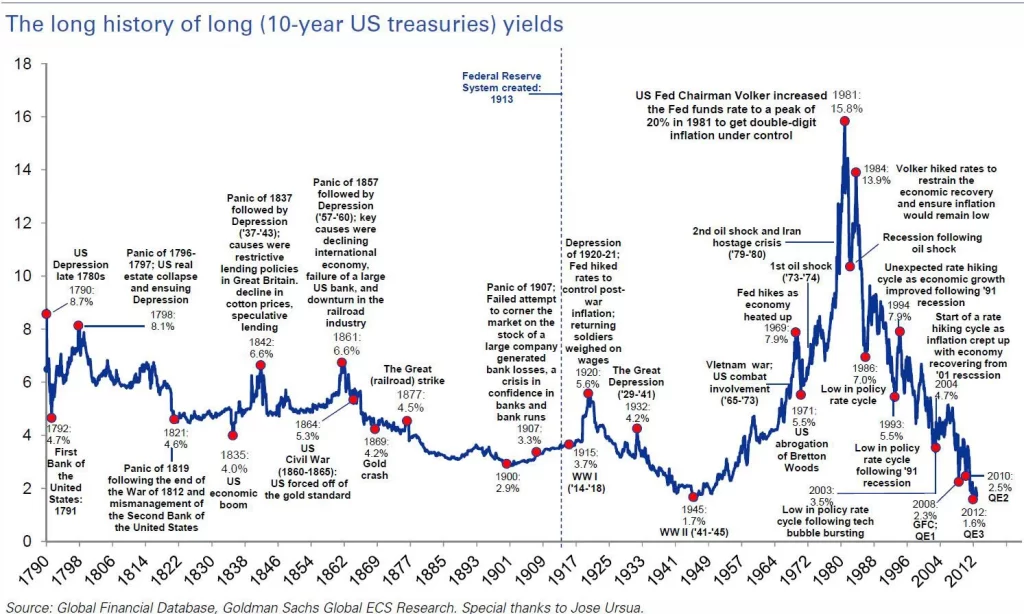

While Presidents appear to take much of the blame and accolades for the success and failure of the economy this is not quite fair. History shows us that the economy is cyclical in nature. Take a look at the chart below as an example of the ups and downs of the American economy.

As you can see by even a cursory examination of the graph there have been periods of great productivity as well as growth. In general you can note that we have had our ups and downs. I am sure what jumps out at you is the Great Depression. This

chart really shows how low productivity really was and how little spending was going on. Of course this was followed by huge government spending on World War II that essentially got us out of the Depression.

Further examination notes that almost every time there is a war our economy’s productivity and spending go up to correspond to the wartime spending. You can also note typical post war declines.

You should also pay attention to the longest period of continued economic growth and prosperity. My interpretation shows either W.W.II or Vietnam as the longest sustained growth and that was buoyed by wartime spending. Either way the longest period would be 2 to 4 years tops. Now figure this, since 1992, the end of the graph, our production has risen every year. That puts us smack in the middle of the longest period of sustained economic growth in our nations history. Its now 9 years and shows no immediate signs of slowing down. History and graph tell us however, that it has to end sometime, the question is… when?

THE PHASES OF THE BUSINESS CYCLE

Economists have certain ways of labeling the business cycle. The business cycle may be defined as the changes that occur to the real GDP because of alternating periods of expansion and contraction. The phases are:

1. Recession:

A decline in the real GDP that occurs for at least two or more quarters. Recessions feed on themselves. During a recession, business people spend less than they once did. Because sales are failing, businesses do what they can to reduce their spending. They lay off workers, buy less merchandise, and postpone plans to expand. When this happens, business suppliers do what they can to protect themselves. They too lay off workers and reduce spending.

As workers earn less, they spend less, and business income and profits decline still more. Businesses spend even less than before and lay off still more workers. The economy continues to slide.

2. Low Point, or Depression:

State of the economy where there are large unemployment rates, a decline in annual income, and overproduction. The time at which the real GDP stops its decline and starts expanding; the lowest point. Sooner or later, the recession will reach the bottom of the business cycle. How long the cycle will remain at this low point varies from a matter of weeks to many months. During some depressions, such as the one in the 1930s, the low point has lasted for years.

3. Expansion and Recovery:

A period in which the real GDP grows; recovery from a recession. When business begins to improve a bit, firms will hire a few more workers and increase their orders of materials from their suppliers. Increased orders lead other firms to increase production and rehire workers. More employment leads to more consumer spending, further business activity, and still more jobs. Economists describe this upturn in the business cycle as a period of expansion and recovery.

4. Peak:

The point at which the real GDP stops increasing and begins its decline; the highest point.

At the top, or peak, of the business cycle, business expansion ends its upward climb. Employment, consumer spending, and production hit their highest levels. A peak, like a depression, can last for a short or long period of time. When the peak lasts for a long time, we are in a period of prosperity.

One of the dangers of peak periods is that of inflation. During periods of inflation, prices rise and the value of

money declines. Inflation is more of a threat during peak periods because employment and earnings are at high levels. With more money in their pockets, people are willing to spend more than before. In this way, demand is increased and prices rise.

HOW DO ECONOMISTS KEEP TRACK OF THE BUSINESS CYCLE?

For many years, economists have tried to understand why there are ups and downs in that nation’s economy. They want to learn what can be done to prevent recessions and maintain prosperity. Therefore, they ask the following questions: (1) In what phase of the business cycle is our economy at the present time? (2) Where is the business cycle heading?

To date, economists believe that there are five causes of the business cycle.

The first cause is changes in capital expenditures. When the economy is strong, businesses have expectations of sales growth; they invest heavily in capital goods. After a while, businesses may decide that they have expanded to their

limit, so they begin to pull back on their capital investments and cause an eventual recession.

The second cause of the business cycle is inventory adjustments. At the first sign of an economy reaching its peak, there are some businesses that cut back their inventories and then build them back up again at the first sign of a trough. Either action causes the real GDP to fluctuate. Innovation and imitation are the third causes of the business cycle. Innovations include new products, new inventions, or a new way of performing a task. When a business innovates, it often gains an edge on its competitors because its costs decrease or its sales increase. Whatever the case, profits increase and the business grows. If other business in the same industry want to keep up, they then copy what the innovator has done (imitation) or they come up with something better. Imitation companies usually invest heavily and an investment boom follows. Once the innovation spreads to another industry, the situation changes. Further investments are unnecessary and economic activity may slow.

The fourth cause of the business cycle are the credit and loan policies of commercial banking. When “easy money” policies are in effect, interest rates are low and loans are easy to get. They encourage the private sector to borrow and invest, thus stimulating the economy. Eventually the increased demand for loans causes the interest rates to rise, which discourage new borrowers. As borrowing and spending slow down, the level of economic activity declines. The economy keeps declining until interest rates fall and the business cycle begins over again.

The fifth and final cause of the business cycle if external shocks. Shocks such as increases in oil prices, wars, and international conflict, have the potential to either drive the economy up, or drive it down. The economy may benefit when a new supply of natural resources is discovered. Such was the case with Great Britain in the 1970’s when an oil field was discovered off its coast in the North Sea. The British economy of course profited seeing that world oil prices were at an all time high, but the high prices hurt the United States at the same time.

Frequently Asked Questions about the Business Cycle in American Economics:

The Business Cycle, sometimes called the Economic Cycle, refers to the fluctuating periods of economic growth and decline that an economy experiences over time. These periods are characterized by stages like expansion, peak, contraction, and trough. The importance of understanding the Business Cycle lies in its impact on the broader economy. By recognizing where we are in the cycle, policymakers, businesses, and individuals can make informed decisions about investment, employment, and consumption. Furthermore, predicting the various stages of the cycle helps governments implement counter-cyclical policies to either stimulate growth during downturns or curb inflation during upswings.

The Business Cycle comprises four main stages:

Expansion: This is a period when the economy is growing, marked by rising GDP, low unemployment, and increasing investment. Consumer confidence is typically high.

Peak: This is the point at which the expansion tops out. At this stage, the economy is at its maximum output, unemployment is at its lowest, and inflation may start to rise.

Contraction: Following the peak, the economy starts to decline. GDP falls, unemployment begins to rise, and consumer spending may decrease. This can lead to a recession if it’s prolonged.

Trough: The lowest point in the cycle, this is where the economy bottoms out. From this point, the economy starts to recover and moves back into an expansion phase.

Each of these stages poses its own challenges and opportunities for businesses, investors, and policymakers.

External factors, often referred to as exogenous shocks, can significantly influence the trajectory of the Business Cycle. These include geopolitical events, technological innovations, natural disasters, and global pandemics. For example, a major oil price shock can lead to higher production costs, subsequently slowing down economic growth. Similarly, innovations like the internet can spur new industries, leading to rapid expansion. Understanding these factors helps in forecasting potential disruptions or accelerations in the Business Cycle.

The Federal Reserve, often just called “the Fed”, uses monetary policy to influence the Business Cycle. Its primary objectives are to stabilize prices and achieve maximum employment. The Fed adjusts the short-term interest rates, either raising them to curb inflation during expansions or lowering them to stimulate borrowing and investment during contractions. Additionally, the Fed employs tools like open market operations, discount rates, and reserve requirements to regulate the money supply and keep the economy on track.

Both recessions and depressions are downturns in the Business Cycle, but they differ in severity and duration. A recession is a period of declining economic activity that lasts for a short duration, typically defined by two consecutive quarters of negative GDP growth. It’s marked by reduced consumer spending, increasing unemployment, and declining business investments.

On the other hand, a depression is a prolonged and deep economic downturn. Depressions last longer than recessions, often several years, and are characterized by extreme unemployment, a significant drop in GDP, widespread business failures, and severe deflation.

Recognizing the difference is crucial because the policy responses required for each can be different, and the economic implications for households and businesses vary considerably between the two.